How Financial Advicers Can Write, Publish, And Distribute Their Own Book To Create A More Effective Impression On Prospective Clients

Nerd's Eye View

NOVEMBER 27, 2023

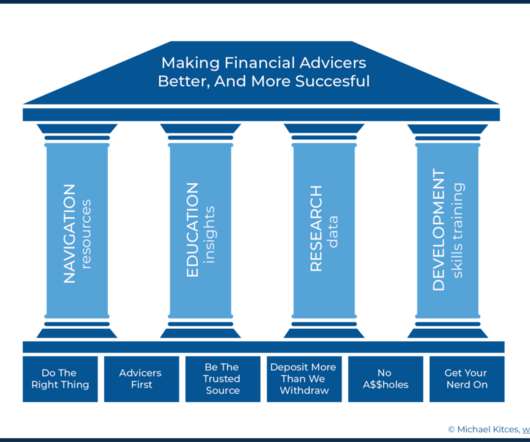

One of the main goals of financial advisors who market themselves is to build a foundation of trust with their prospective clients so that they feel comfortable in discussing often-sensitive financial topics and ultimately acting on the advisor's recommendations.

Let's personalize your content