"Tell Us What We're Supposed To Do"

Random Roger's Retirement Planning

MAY 17, 2024

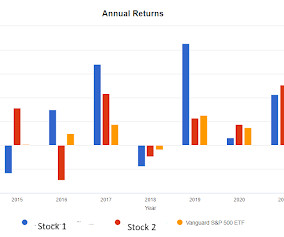

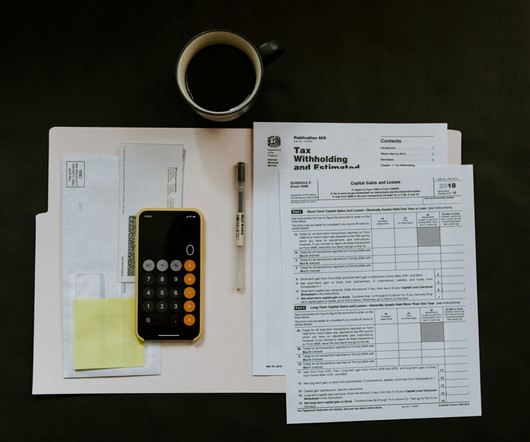

At the same time, corporate downsizing and poor health is forcing the hand of many people into retiring early, whether they are ready or not. In past posts, we've talked downsizing into a smaller house and getting cash out of the trade. It framed some of my beliefs very well. So it is up to use to solve our own problem.

Let's personalize your content