Research links: better behavior

Abnormal Returns

APRIL 16, 2024

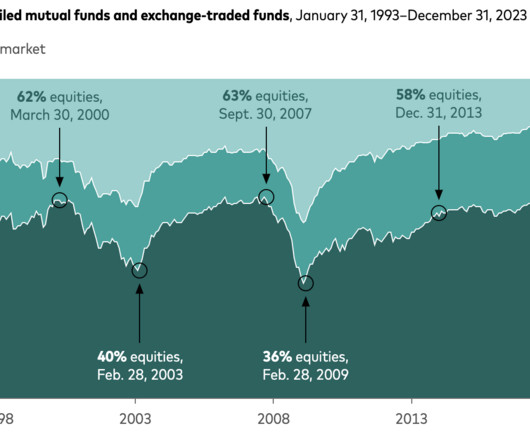

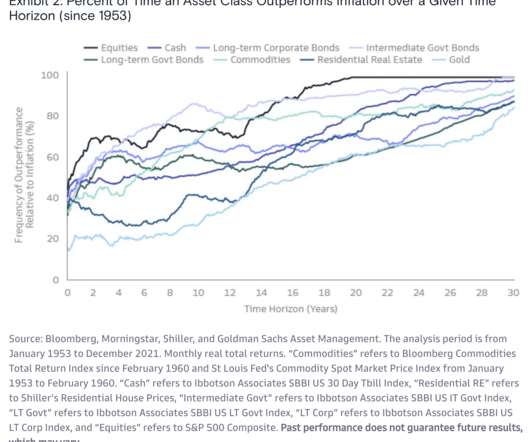

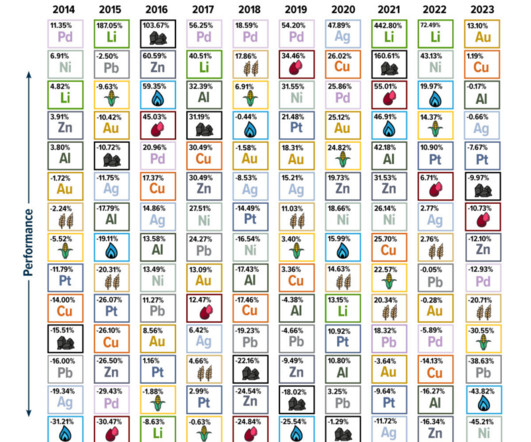

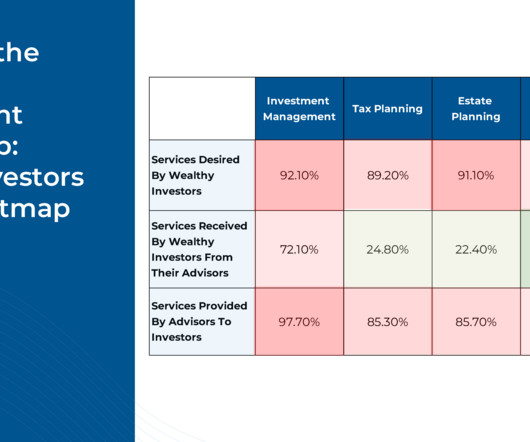

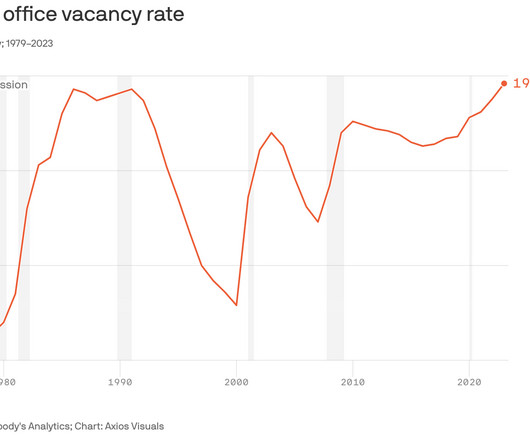

Asset allocaiton Is regret a better measure to target for portfolio allocations? blogs.cfainstitute.org) Why asset allocation is sensitive to goals and assumptions. wisdomtree.com) What happens to the stock market on days before holidays. priceactionlab.com) The case against a cryptocurrency allocation.

Let's personalize your content