Research links: better behavior

Abnormal Returns

APRIL 16, 2024

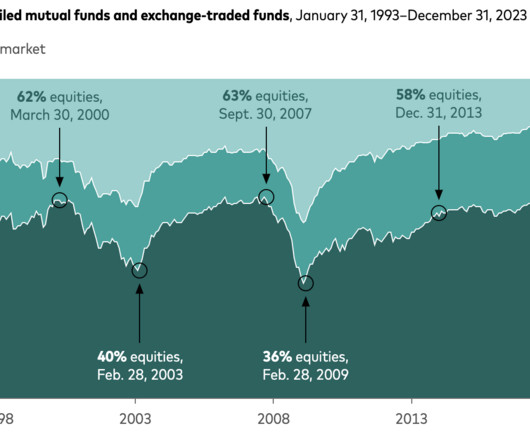

Asset allocaiton Is regret a better measure to target for portfolio allocations? blogs.cfainstitute.org) Why asset allocation is sensitive to goals and assumptions. priceactionlab.com) The case against a cryptocurrency allocation. wisdomtree.com) What happens to the stock market on days before holidays.

Let's personalize your content