Incorporating Return Stacking?

Random Roger's Retirement Planning

MARCH 29, 2024

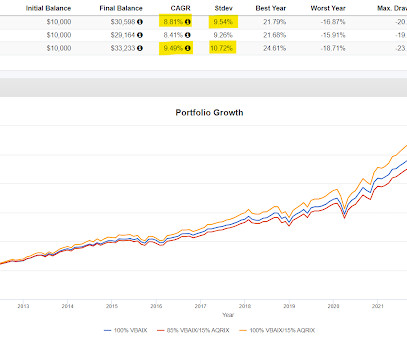

The first idea for sequence of return risk, yes, the numbers will pretty much work out as far as replicating 100% with 95% invested as described. If you've ever studied top down portfolio construction you've probably read that getting asset allocation decisions correct accounts for about 70% of the return achieved.

Let's personalize your content