Research links: the burden of proof

Abnormal Returns

AUGUST 9, 2022

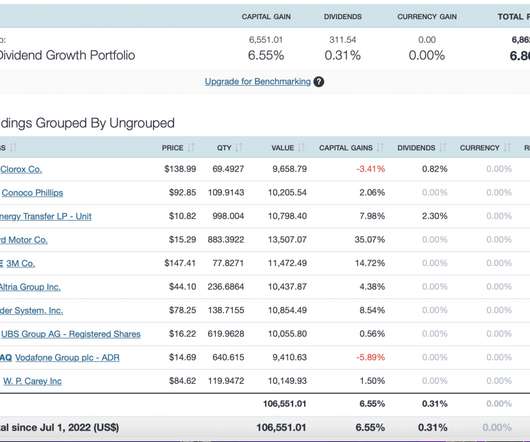

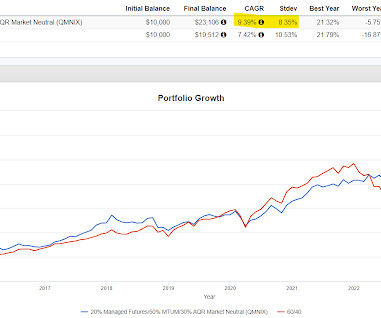

mrzepczynski.blogspot.com) There's not much to see in tactical asset allocation ETF performance. evidenceinvestor.com) Customized portfolios are by definition more concentrated. (alphaarchitect.com) Why does trend following work better in a high inflation regime?

Let's personalize your content