Financial Planning Opportunities in a Volatile Market

eMoney Advisor

MARCH 21, 2023

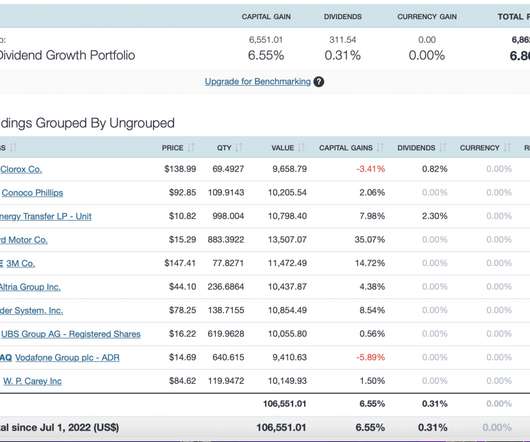

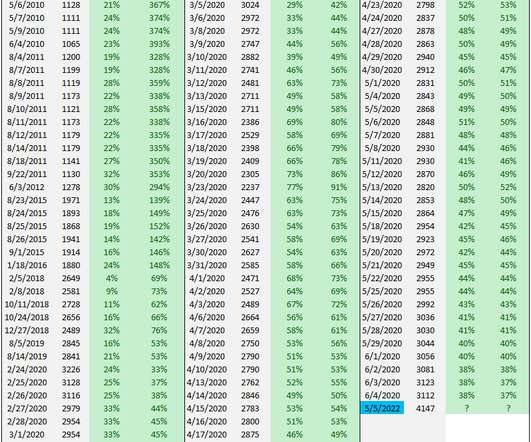

Re-examine Risk Tolerance Volatile markets may cause your clients to rethink their risk tolerance, especially those who are close to retirement. Portfolio Rebalancing Depending on what has been going on in the market, you may have clients whose portfolio asset allocations are no longer in balance.

Let's personalize your content