Sunday links: poor listeners

Abnormal Returns

DECEMBER 3, 2023

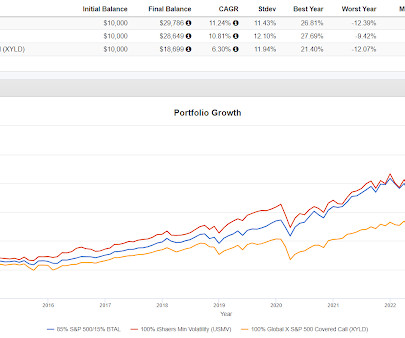

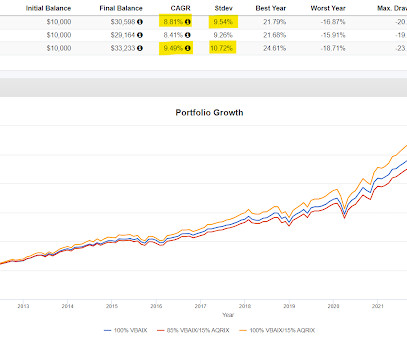

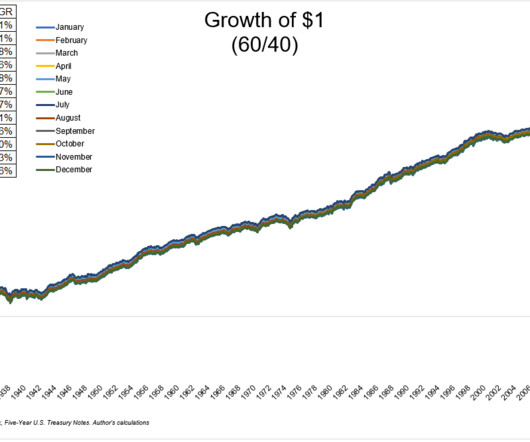

awealthofcommonsense.com) There are a lot of different asset allocations you can live with. downtownjoshbrown.com) College-educated women with children under 10 are in the workforce at record numbers. (wsj.com) Strategy Remember all that talk about how the 60/40 portfolio was broken? axios.com) Q4 GDP is tracking around 1%.

Let's personalize your content