Sunday links: market reversals

Abnormal Returns

DECEMBER 25, 2022

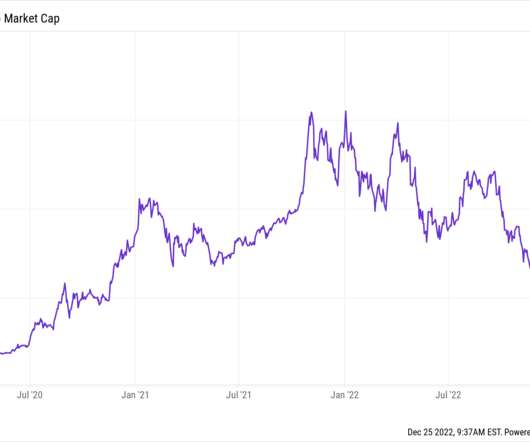

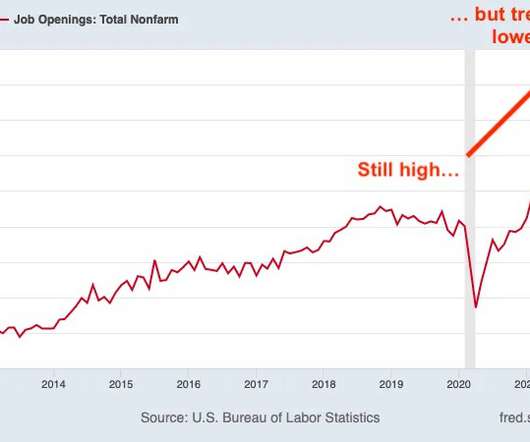

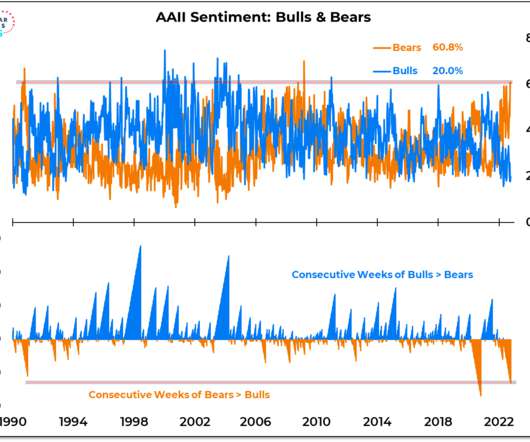

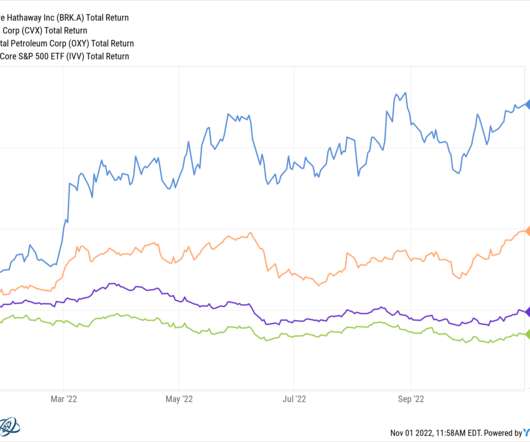

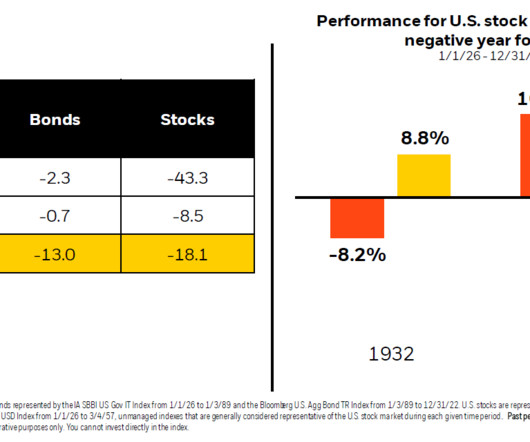

Strategy Six things that don't change in financial markets including the attraction of 'shiny objects.' rock-wealth.co.uk) Companies Not a lot went right for Big Tech in 2022. semafor.com) Just about everything went right for the NFL in 2022. nytimes.com) Economy What kind of landing is the U.S.

Let's personalize your content