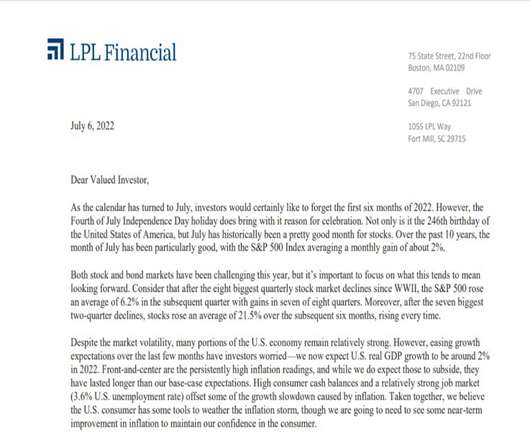

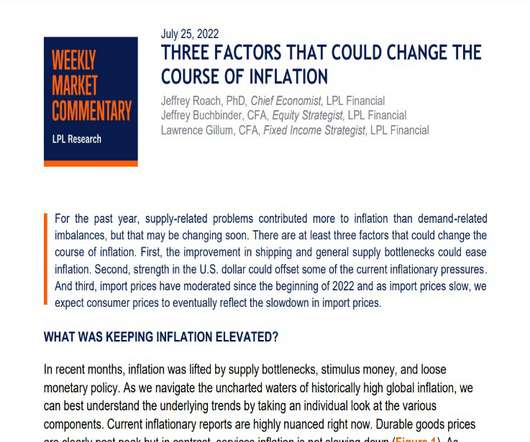

Midyear Outlook 2022 | Navigating Turbulence | July 12, 2022

James Hendries

JULY 13, 2022

We may not be flying into a storm, but there’s been plenty of turbulence the first part of 2022. How businesses, households, and central banks steer through the rough air will set the tone for markets over the second half of 2022. Insurance products are offered through LPL or its licensed affiliates.

Let's personalize your content