Weekly Market Insight – November 7, 2022

Cornerstone Financial Advisory

NOVEMBER 7, 2022

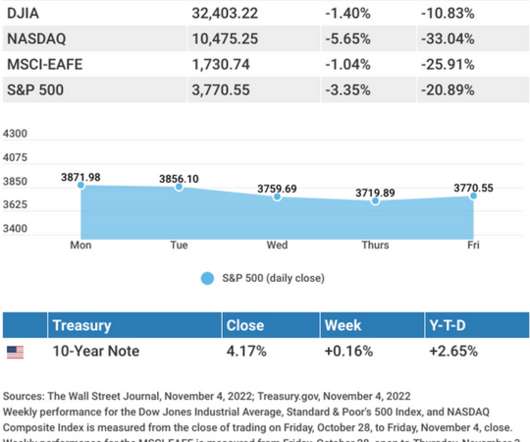

Presented by Cornerstone Financial Advisory, LLC. Hawkish comments by Fed Chair Jerome Powell, following the announcement of another 75 basis points interest rate hike last week, cast a pall over financial markets, sending yields higher and stocks lower. This Week: Key Economic Data. IRS.gov, July 20, 2022.

Let's personalize your content