10 Friday AM Reads

The Big Picture

AUGUST 5, 2022

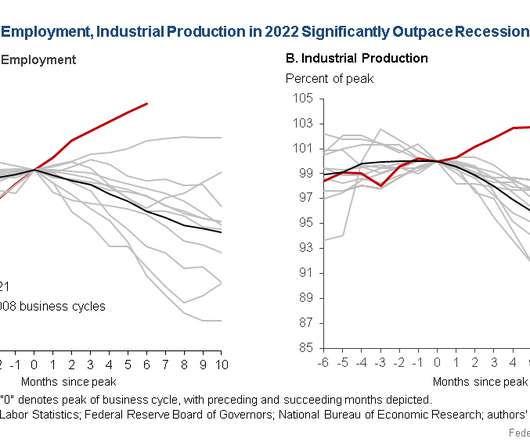

. • Blame History for Making Recession Calls So Hard : The National Bureau of Economic Research has been putting dates on downturns since 1929 — well before there was such a thing as gross domestic product ( Bloomberg ) see also Does This Look Like a Recession To You? 2020 threw a wrench in everything. . • Contradictions abound.

Let's personalize your content