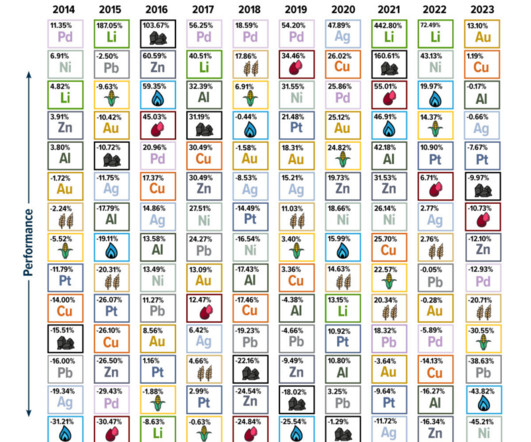

Wealth Inequality Starts at the Top

The Big Picture

JUNE 22, 2023

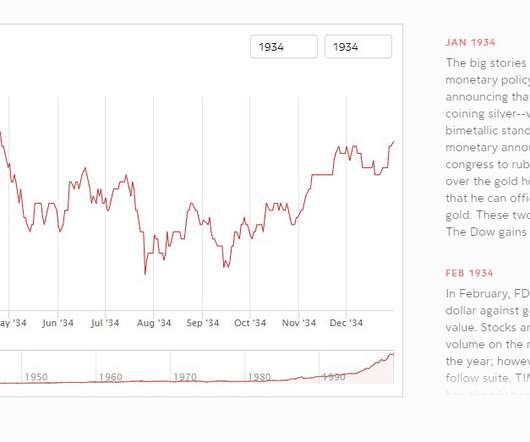

It shows “Share of Total Assets Held by the Bottom 50% ( red line ) versus the Share of Total Assets Held by the Top 0.1% ( green line ). Consider the chart at top, created by Invictus via FRED. That spread is currently just about as wide as its ever been. And, it has accelerated over the past few decades.

Let's personalize your content