Financial Market Round-Up – Jul’23

Truemind Capital

AUGUST 12, 2023

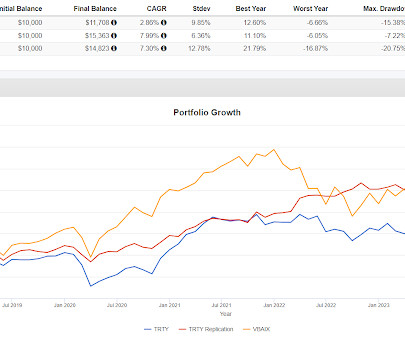

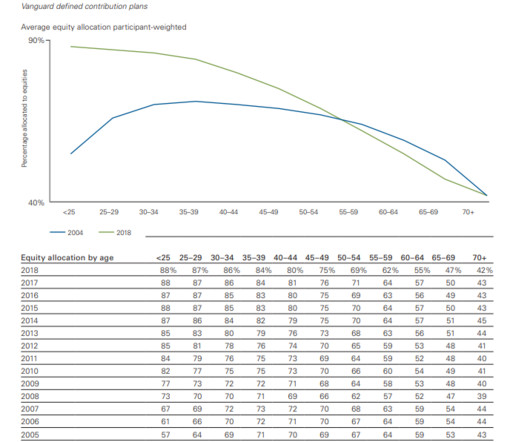

We continue to stay under-allocated to equity (check the 3rd page for asset allocation) at the current valuation levels. Other Asset Classes : After a strong rally, Gold cooled off in Q1FY24 on the back of profit booking and shifting focus towards equity. We continue to prefer a portfolio duration of around 1-1.5

Let's personalize your content