Monthly NFPs Are Rounding Errors

The Big Picture

DECEMBER 8, 2023

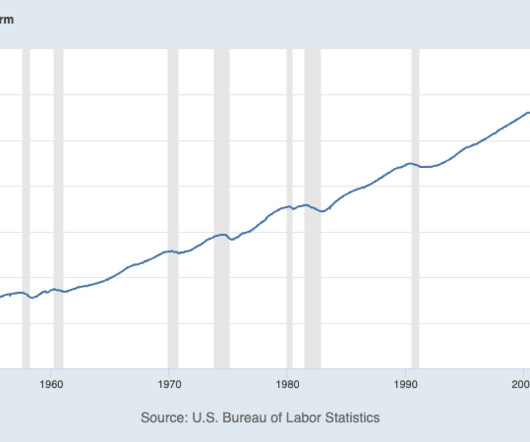

That is a significant number to recall whenever people posit we either are in, or just were in, or are about to tumble into a recession. but most months, the specific number is more or less a rounding error. It was that 157.087 million people are employed full-time in the United States.1 This is not a popular opinion.

Let's personalize your content