At the Money: Managing a Portfolio in a Higher Rate Environment

The Big Picture

APRIL 4, 2024

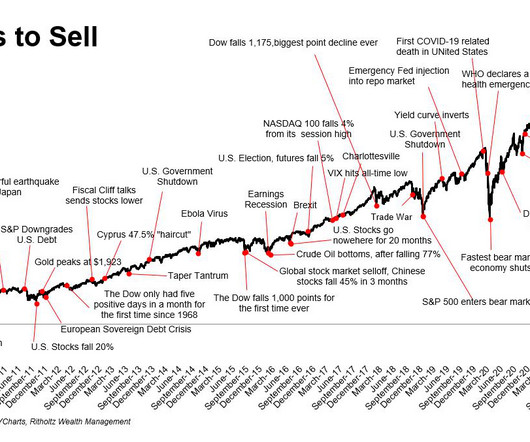

Investors should be considering capturing some of that yield in their portfolios. We’re going to discuss how these changes are likely to affect your portfolios and what you should do about it. The Fed was worried that the psyche of investors was to stay away from Riskier assets like home prices or equities.

Let's personalize your content