Passive vs. Active

The Big Picture

AUGUST 17, 2022

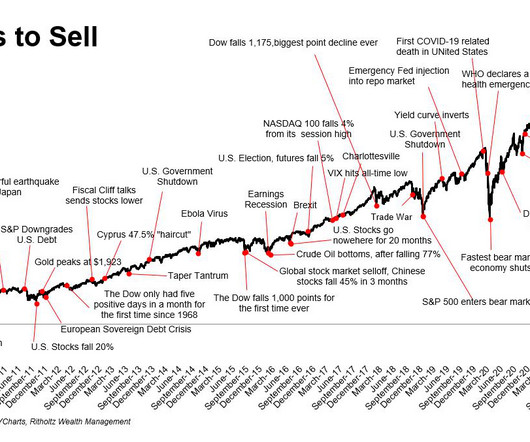

But that is not the same as becoming one of the most dominant asset managers in the world. Top 10 Investor Errors: Excess Fees (June 30, 2012). Dangerous for economy. For sure, ETF and fund fees compound over time, and whether or not they are passive or actively managed doesn’t matter. Passive investing is: Marxist.

Let's personalize your content