Market Commentary: Checking In on Market Fundamentals

Carson Wealth

APRIL 8, 2024

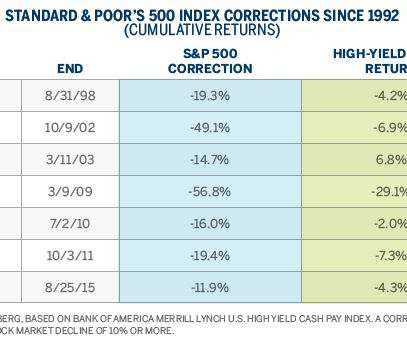

economy continues to look solid, with markets rallying Friday after a stronger-than-expected jobs report. Pockets of attractive valuations exist despite above-average valuations in some high-profile areas of the market. economy, and the job market is leading the way. on average. Payroll growth picked up in recent months.

Let's personalize your content