Join The Bond Market Resistance!

Random Roger's Retirement Planning

APRIL 22, 2024

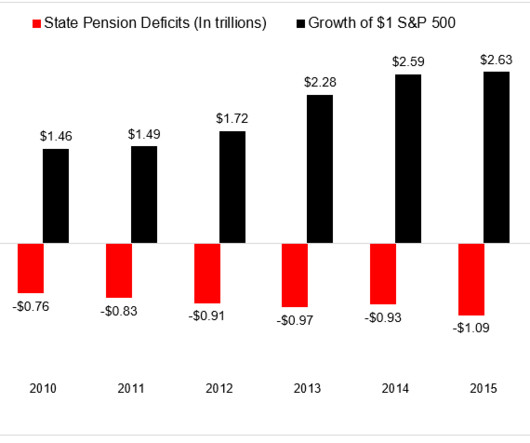

The article devoted a good amount of space to bond market math, focusing on the pain of owning the iShares 20+ Year Treasury ETF (TLT) and bond funds in general. I found an interview I did with Seeking Alpha in late 2010 that made its way to NASDAQ.com. Here's the relevant excerpt. It turned out it did matter starting in late 2021.

Let's personalize your content