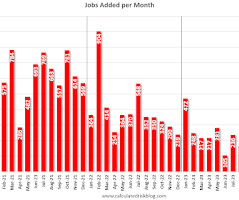

Question #2 for 2024: How much will job growth slow in 2024? Or will the economy lose jobs?

Calculated Risk

JANUARY 10, 2024

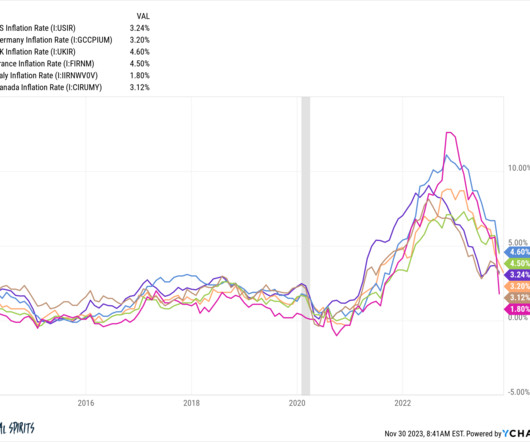

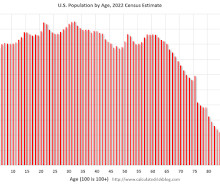

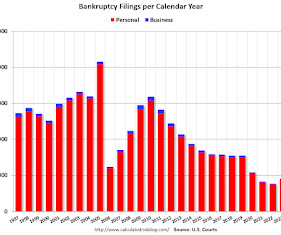

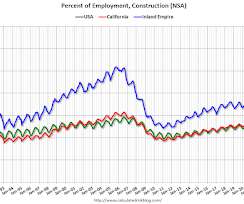

2) Employment: Through November 2023, the economy added 2.6 Or will the economy lose jobs? The bad news - for job growth - is that a combination of a slowing economy, demographics and a labor market near full employment suggests fewer jobs will be added in 2024. Or will the economy lose jobs? million jobs in 2023.

Let's personalize your content