5 Unusual Economic Indicators That Can Tell You About the Economy

Trade Brains

DECEMBER 28, 2023

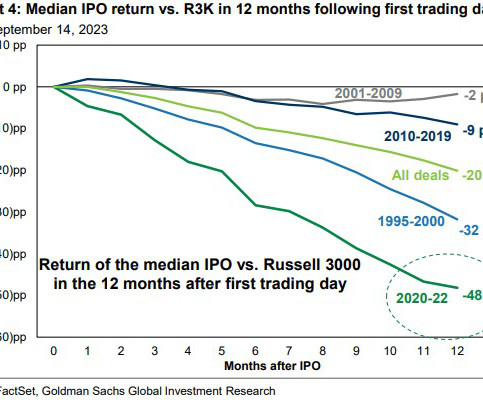

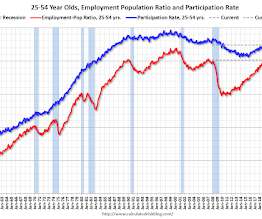

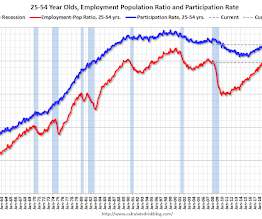

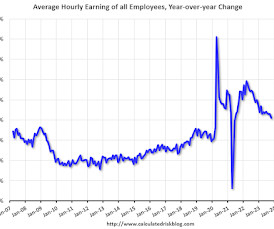

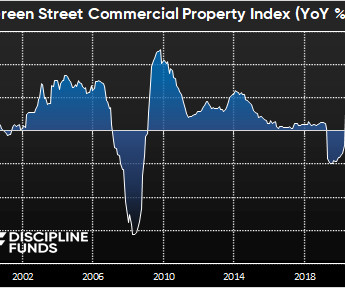

Unusual Economic Indicators : You might have heard about indicators like the Big Mac Index (if you haven’t, you can read our previous article). Today, we’ll introduce you to some unusual economic indicators that might predict the economic conditions. Most Unusual Economic Indicators 1. What is it? What is the proof?

Let's personalize your content