Tax Planning for Startup Founders and Employees

Harness Wealth

FEBRUARY 26, 2023

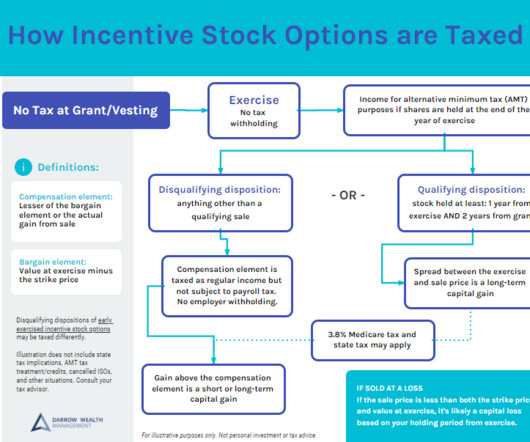

Cost-saving tax planning can be much more difficult to implement after your company is well-established and has reached the stage where an IPO, merger, or acquisition becomes a likely event. The first three options are pass-through entities, so profits and losses are distributed to the owners who are taxed on them.

Let's personalize your content