A Guide To Conducting And Documenting An Annual Compliance Review Under New SEC Amendment

Nerd's Eye View

OCTOBER 11, 2023

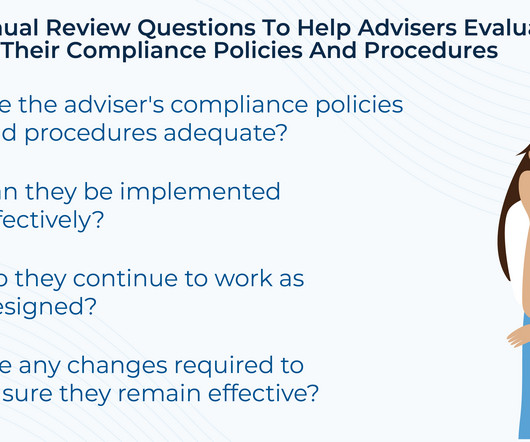

In 2004, the SEC significantly strengthened the compliance responsibilities of investment advisers when Rule 206(4)-7 (also known as the "Compliance Rule") went into effect, requiring them to adopt and implement written compliance policies and procedures, review such policies and procedures annually, and designate a Chief Compliance Office to administer such policies and procedures.

Let's personalize your content