This is How Stocks Bottom

The Irrelevant Investor

FEBRUARY 25, 2022

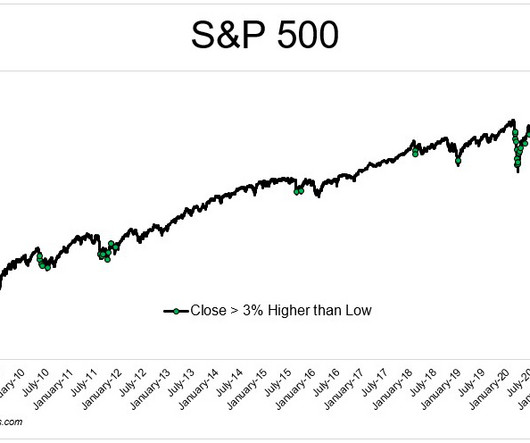

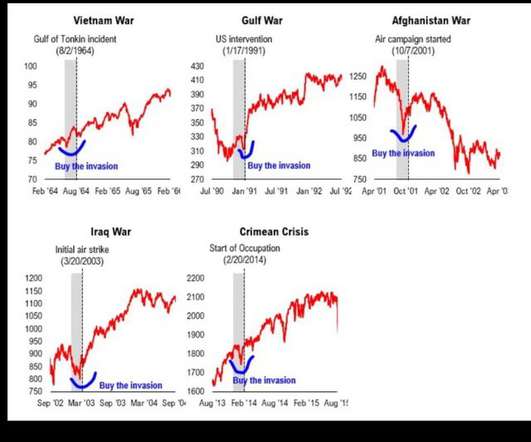

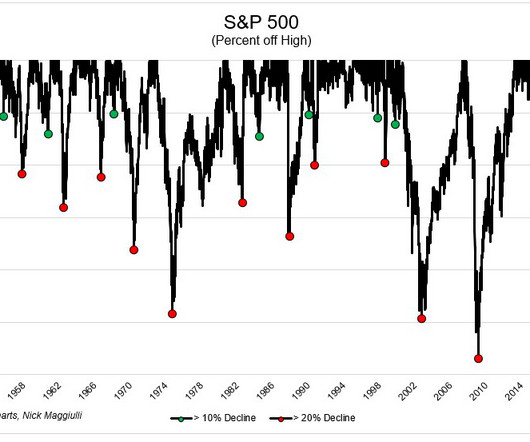

When the market opened yesterday, the S&P 500 was down as much as 2.6%, leaving it 14.6% below December's highs. But then the selling stopped and the buying started. It picked up steam and was a full-blown panic by the end of the day. By the close, stocks had rallied 4.1% off the lows. If you're looking for signs of a bottom, the good news is that this is how they happen.

Let's personalize your content