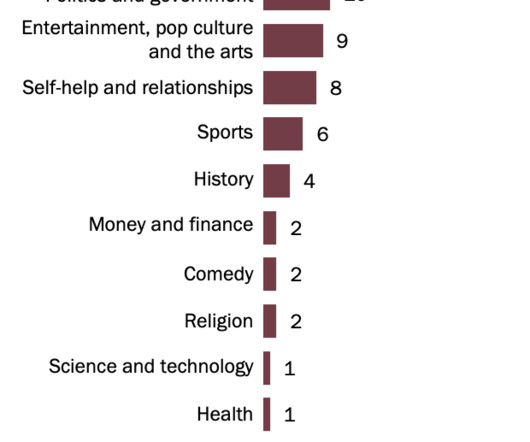

Summer Reading List Of “Best Books” For Financial Advisors – 2023 Edition

Nerd's Eye View

JUNE 12, 2023

While 2023 got off to a bumpy start for many advisory firms, still smarting from a rough prior year of market returns (and volatile revenue), a relative return to ‘normalcy’ means that for most, the advisory business has reached whatever its new post-pandemic normal will be. Firms that were returning to the office have done so, those that are staying remote are remaining as such, and either way most advisory firms have figured out how to continue to service and retain clients, and ar

Let's personalize your content