Private Credit Giants Are Butting Heads Over a Hot New Asset Class

Wealth Management

NOVEMBER 6, 2023

PE-style “whitelists” hamper efforts to expand the secondary market for fund stakes, as regulators raise liquidity concerns about private capital.

Wealth Management

NOVEMBER 6, 2023

PE-style “whitelists” hamper efforts to expand the secondary market for fund stakes, as regulators raise liquidity concerns about private capital.

The Big Picture

NOVEMBER 6, 2023

Source: Chartr We talked about this 2 weeks ago , but the nation missed a fantastic opportunity to refinance all of the outstanding US debt at much lower levels. Every corporate debt issuer and homeowner in America refinanced at lower rates — except for Uncle Sam. If you were in Congress from 2015-2021, you are the reason why HALF of the projected federal debt will soon be interest payments.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

NOVEMBER 5, 2023

Top clicks this week Six lessons from William Bernstein's "The Four Pillars of Investing." (humbledollar.com) Be wary shifting too much of your money into bonds. (humbledollar.com) There's nothing magic about asset allocation. (obliviousinvestor.com) Money market returns look good.almost too good. (wsj.com) Traders are buying the dip in the iShares 20+ Year Treasury Bond ETF ($TLT).

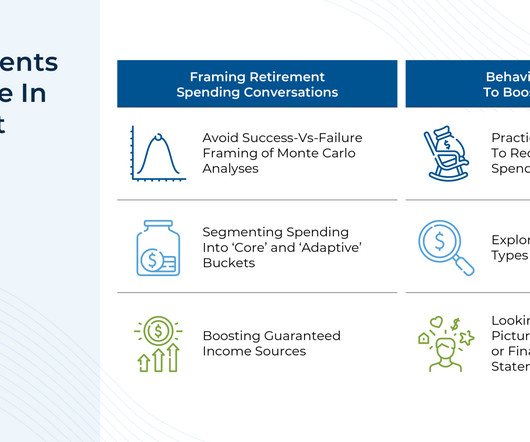

Nerd's Eye View

NOVEMBER 8, 2023

Retirement is often framed as one's "golden years", a time to enjoy the fruits of several decades of hard work. And for many retirees who have planned accordingly, this transition is not a problem as they might spend generously on travel, hobbies, or other pursuits. Nevertheless, some retirees can find it emotionally challenging to bring themselves to go beyond the basics in retirement spending (e.g., because they have a hard time switching from 'savings' mode to 'spending' mode) and can be hesi

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

The Reformed Broker

NOVEMBER 10, 2023

OK, we’re trying something new next week for registered financial advisors only. It’s a brand new show we’ve created and you can be there virtually to watch the pilot episode live. As an advisor, you’re going to spend time, money and energy implementing new technology and asset management solutions into your practice. You may as well get good at it.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

NOVEMBER 4, 2023

EVs The EV business has hit a speed bump. (theverge.com) Tesla ($TSLA) has an Elon Musk problem. (lefsetz.com) EVs have an affordability problem. (businessinsider.com) Solid state batteries will change the EV equation. (axios.com) Transport Just how quickly can the shipping industry green itself? (nytimes.com) Railroad companies have been lax in maintaining bridges.

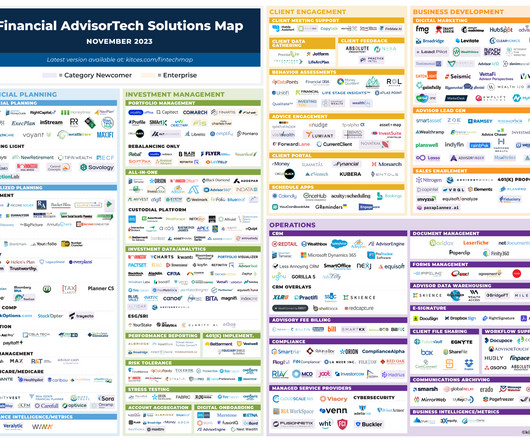

Nerd's Eye View

NOVEMBER 6, 2023

Welcome to the November 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that Practice Intel has launched a new "growth platform" centered around quantifying the quality of an advisor's client relationships with an all-in "Relationship Quality Index" (RQI) – which while

The Reformed Broker

NOVEMBER 8, 2023

On this special episode of TCAF Tuesday, Michael Batnick, Barry Ritholtz, and Downtown Josh Brown are joined by Campbell Harvey to discuss: the state of the economy, the yield curve indicator, the next recession, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods! Listen here: Apple podcasts Spotify podcasts Google podcasts Everywhere else!

The Big Picture

NOVEMBER 4, 2023

This week, we speak with Zeke Faux ,1 an investigative reporter for Bloomberg Businessweek and Bloomberg News. He has won the Gerald Loeb Award for explanatory journalism and the American Bar Association’s Silver Gavel Award , and was a National Magazine Award finalist. He is the author of Number Go Up: Inside Crypto’s Wild Rise and Staggering Fall.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Abnormal Returns

NOVEMBER 8, 2023

Markets The stock market usually goes up. (tker.co) Like it or not, technology stocks are leading. (allstarcharts.com) Technology How does the technology industry not get bigger? (notboring.co) OpenAI is laying out a path forward for a sustainable business. (stratechery.com) Meta ($META) has a path forward for WhatsApp profitability. (nytimes.com) Amazon ($AMZN) is going wide with offers for One Medical membership.

Nerd's Eye View

NOVEMBER 10, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a Fidelity benchmarking study revealed that both small and large RIAs saw positive organic growth in 2022, helping to mitigate AUM declines resulting from weak market performance. The report also flagged that profit margins for RIAs remained relatively steady over the past several years (despite strong market performance over the period), with the trend of firms offe

The Reformed Broker

NOVEMBER 10, 2023

On episode 117 of The Compound and Friends, Michael Batnick and Downtown Josh Brown are joined by Callie Cox and Malcolm Ethridge to discuss: market sentiment, Robinhood earnings, Warren Buffett and his cash, interest rates, the yield curve, recession calls, weight loss drugs, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

The Big Picture

NOVEMBER 10, 2023

I was recently asked how many Masters in Business guests have won a Nobel Prize. The list appears to be mostly (but not exclusively) behavioral finance types; here is the short-list of laurates, plus a few related columns of Nobel Winners: Danny Kahneman on Noise (May 15, 2021) Paul Krugman on Zombie Ideas (February 15, 2020) Gene Fama (with David Booth) on Efficient Markets (November 9, 2019) Michael Spence, on the Dynamics of Information Signaling (October 26, 2019) Robert Shiller on Narrative

Speaker: Joe Buhrmann, MBA, CFP®, CLU®, ChFC® Senior Financial Planning Practice Management Consultant eMoney Advisor

During an era of evolving consumer preferences, the banking sector is undergoing a profound shift. As customers continue to broaden their perspectives, banking professionals must support their customers' financial wellness by providing holistic financial advice that aligns with individual goals and circumstances. Without adapting, financial institutions will find that loyalty may crumble amid uncertainty.

Abnormal Returns

NOVEMBER 10, 2023

Strategy The 40 of the 60/40 portfolio is finally earning people something. (awealthofcommonsense.com) There's still no sign of a turn in the trend favoring U.S. vs. international equities. (allstarcharts.com) The case for bonds. (blogs.cfainstitute.org) Energy Solar panel manufacturing is finally on the rise in the U.S. (nytimes.com) Why the cancellation of the NuScale, small modular reactor, project is such a bummer.

Meb Faber Research

NOVEMBER 8, 2023

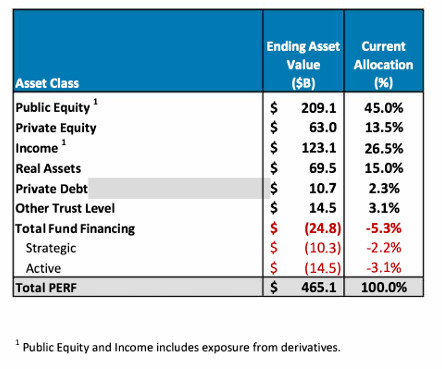

“He was a U.S.-class smooth politician, which is the only way you’re going to survive in that job. It has nothing to do with investing.” That’s how Institutional Investor recently described a former CIO of the California Public Employees’ Retirement System, also known as CalPERS. The description is especially interesting when considering that the “I” […] The post Should CalPERS Fire Everyone And Just Buy Some ETFs?

The Reformed Broker

NOVEMBER 5, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. These are the most read posts on the site this week, in case you missed it: . The post This Week on TRB appeared first on The Reformed Broker.

The Big Picture

NOVEMBER 10, 2023

My end-of-week morning train WFH reads: • What the US got right that Europe did not : America’s post-pandemic recovery has left Europe in the dust. ( Financial Times ) • The Land Where Inflation Is Good News : Food and energy price increases triggered by the pandemic and the Ukraine war are helping end the long, bleak era of Japanification. ( Wall Street Journal ) • The Real Reason So Many Asset Managers Are Struggling in China : The world’s second-biggest economy has its own rules of engagement

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Abnormal Returns

NOVEMBER 6, 2023

Podcasts Brendan Frazier on how your clients change will inevitably over time. (wiredplanning.com) Michael Kitces talks with Jon Henderson who is the Founder and CIO for Echo45 Advisors about building a tech stack for a breakaway advisory firm. (kitces.com) Dan Haylett talks with Phil Pearlman about the relationship between health and wealth. (humansvsretirement.com) Custodians Charles Schwab ($SCHW) is laying off staff post-TDA closing.

Wealth Management

NOVEMBER 9, 2023

New York-based Arch, which aims to solve for the workflow and data problems behind alternative investments, has received funding from Focus Financial Partners, the founders of Vanilla and Altruist, and others.

Alpha Architect

NOVEMBER 10, 2023

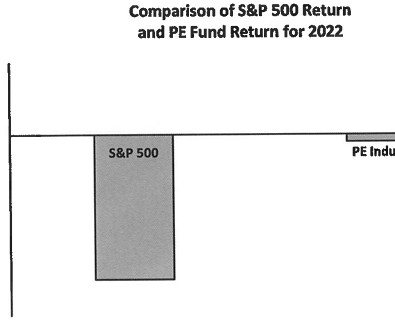

The claims of superior risk-adjusted performance by the PE industry are exaggerated. Given their lack of liquidity, opaqueness, and greater use of leverage, it seems logical that investors should demand something like a 3-4% IRR premium. Yet, there is no evidence that the industry overall has been able to deliver that. The Performance of Major Private Equity/LBO Firms was originally published at Alpha Architect.

The Big Picture

NOVEMBER 9, 2023

My morning train reads: • Turning Empty Offices Into Apartments Is Getting Even Harder : Only 3,575 apartment units were converted from office space last year. The already fraught process now faces even more challenges. ( Wall Street Journal ) • The problem isn’t inflation. It’s prices. What goes up may not come down. Like, ever. ( Vox ) see also Right Now Is a Bad Time to Spend Money : With prices and interest rates high, this is a moment to focus on saving. ( Wall Street Journal ) • How to Be

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Abnormal Returns

NOVEMBER 10, 2023

Economy Kyla Scanlon talks with David Dayen about the gap between the economy and consumer sentiment. (youtube.com) Justin Carbonneau and Jack Forehand talk all things macro with 3Fourteen Research founders Warren Pies and Fernando Vidal. (youtube.com) Business Matt Reustle talks with Staley Cates about the history of FedEx ($FDX). (joincolossus.com) Jordan Harbinger talks with Chris Miller author of "Chip War: The Fight for the World's Most Critical Technology.

Trade Brains

NOVEMBER 9, 2023

BoB World App Scam : The RBI raised a red flag against the Bank of Baroda (BoB) and has suspended their mobile app ‘BoB World’ from onboarding new clients because of a 22 lakh fraud affecting 362 customers. Nearly six customers have lost around Rs. 1.1 lakh each, whereas one lost almost Rs. 1.77 lakh, and an agent stole over Rs. 3.96 lakh. So, what in the world is ‘BoB World’?

Wealth Management

NOVEMBER 8, 2023

For the second straight month, sponsors launched dozens of new ETFs. That included eight bond ETFs, one commodoties ETF, 45 equities-based ETFs, 12 target date/multi-asset ETFs and four others.

Calculated Risk

NOVEMBER 6, 2023

From the Federal Reserve: The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the third quarter of 2023.

Advertisement

Digital platforms can provide you with plenty of solutions, yet many are still intimidated by them. It's time to end that worry and embrace what could make a major difference for your bank. Understanding how they work and how to best utilize them for your banks is key toward success. In this article, Biz2X breaks down all things digital platforms, including the many advantages of embracing them.

Abnormal Returns

NOVEMBER 7, 2023

Retail Does social media use increase stock market participation? (papers.ssrn.com) Why do individual investors converge on the same stocks? (papers.ssrn.com) Companies What is organizational capital and how does it affect returns? (alphaarchitect.com) Poor ESG scores don't prevent new share issuance. (papers.ssrn.com) Quant stuff Research shouldn't happen in a vacuum.

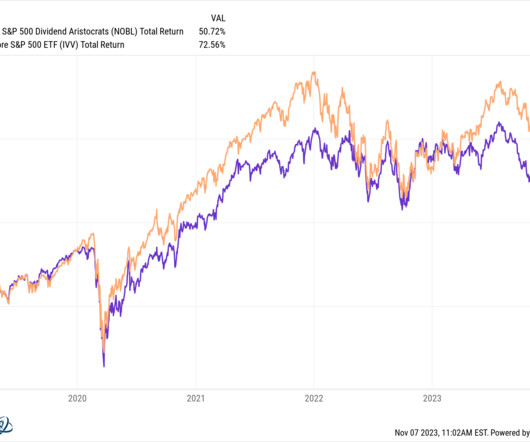

A Wealth of Common Sense

NOVEMBER 9, 2023

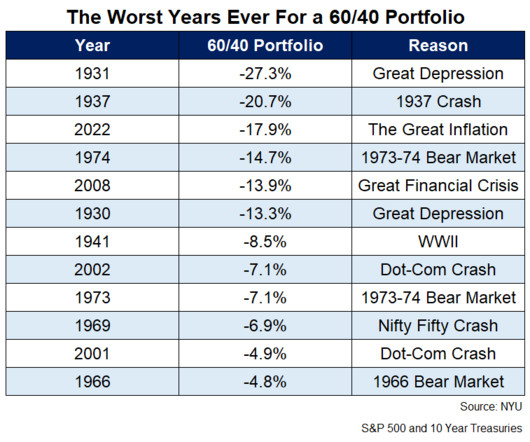

A reader asks: Can you please explain why financial media personnel keep saying the 60/40 is dead but they are not saying target date funds are dead? Last year was one of the worst years ever for a 60/40 portfolio of U.S. stocks and bonds. These are the 10 worst calendar year returns for a portfolio comprising the S&P 500 and 10 year Treasuries going back to 1928: By my calculations, 2022 was the third worst year for.

Wealth Management

NOVEMBER 9, 2023

Industry sources say Focus Financial Partners' new private equity owner plans to merge the sprawling ecosystem of firms into a small number of its existing entities.

Let's personalize your content