RIA Code Of Ethics: Important Nuances To Note In Relatively Straightforward Requirements

Nerd's Eye View

JUNE 21, 2023

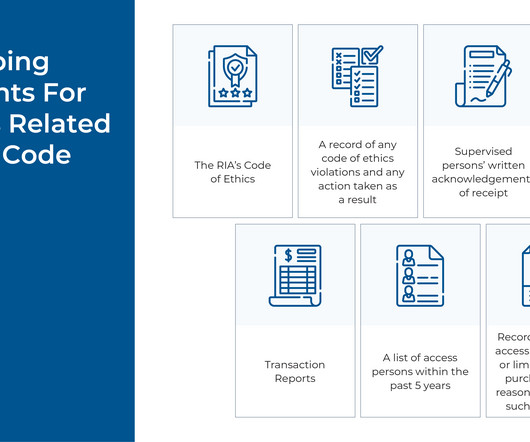

All investment advisers are fiduciaries that owe a duty of care and loyalty to their clients, and, in an ideal world, advisory firms and their staff would abide by these requirements without the need for a prescriptive code of ethics. However, the early 2000s were plagued by a variety of SEC enforcement actions that alleged fiduciary duty violations – primarily involving trading abuses by investment advisory personnel – which led the regulator to create a rule (that became effective

Let's personalize your content