The Trouble with Sentiment

The Big Picture

AUGUST 10, 2022

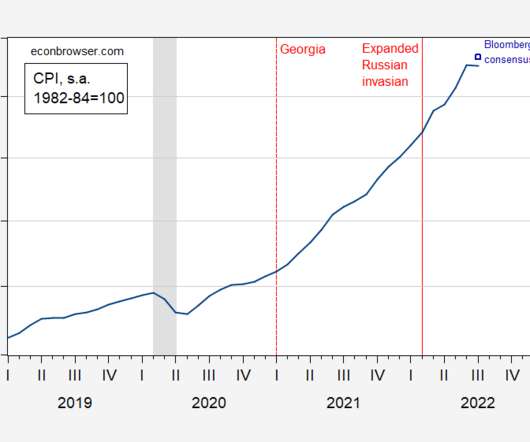

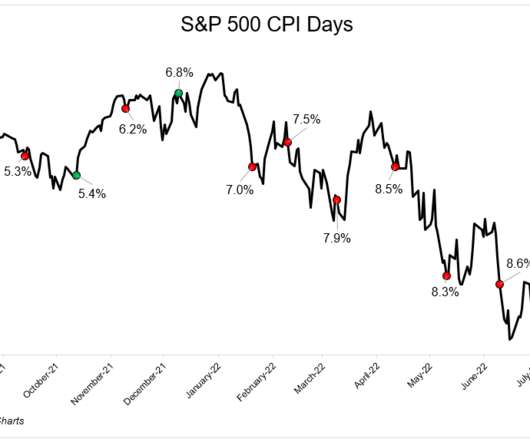

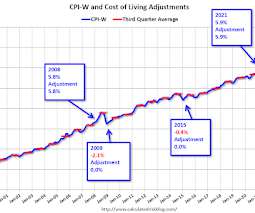

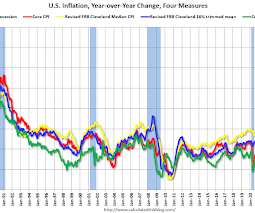

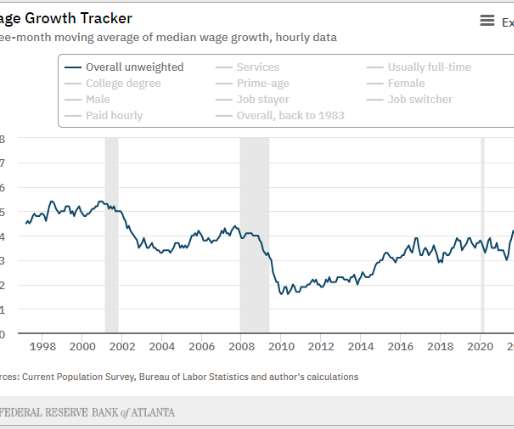

Barry Ritholtz, Ritholtz Wealth Management Chairman and CIO & “Masters in Business” host, discusses recession risk and inversion of the 2-year/10-year curve. US Economy Facing Growth Recession. ?. Source: Bloomberg , August 9th, 2022. See also : Blame Election Deniers for Faltering Consumer Sentiment. by Matthew A. Winkler. Bloomberg, August 8, 2022.

Let's personalize your content