Monday links: overrating education

Abnormal Returns

NOVEMBER 13, 2023

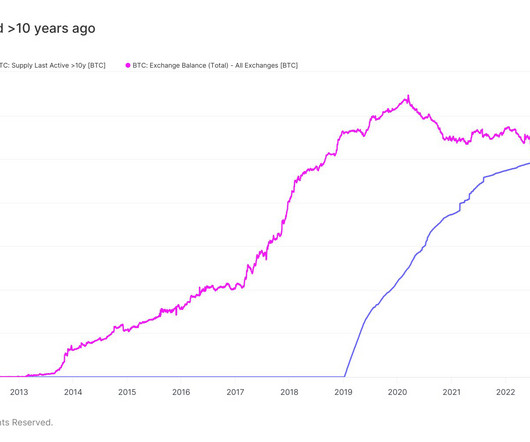

Crypto The crypto industry is at a crossroads, post-FTX. (on.ft.com) Michael Batnick and Ben Carlson talk with Chris Kuiper, Director of Research at Fidelity Digital Assets. (theirrelevantinvestor.com) Startups The startup scene is living in two different worlds: AI and everything else. (theinformation.com) What rate of return do successful VCs need to get from their investments?

Let's personalize your content