More Inflation Expectations Silliness

The Big Picture

JULY 5, 2023

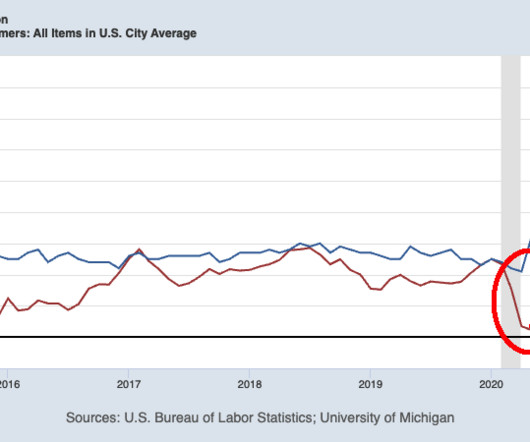

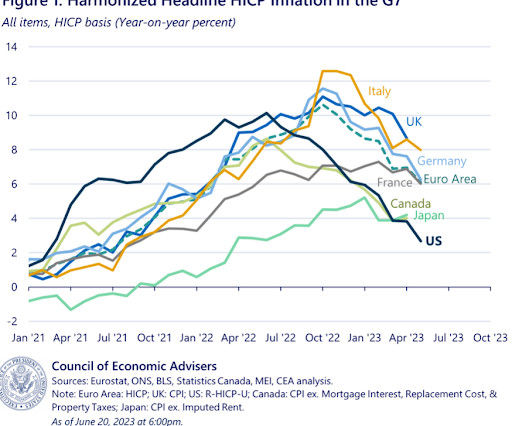

This morning, the WSJ reported that “Consumers expect to see 4.1% inflation a year from now, the lowest such reading in two years and down sharply from its recent peak of 6.8%.” There are some who believe this is good news, but as we pointed out in May , it’s a meaningless, lagging survey. In fact, it may be even worse than that, because it appears that some at the Federal Reserve actually believe the Fed’s own survey of consumers contains information.

Let's personalize your content