Investing Behavioral Hacks

The Big Picture

NOVEMBER 15, 2023

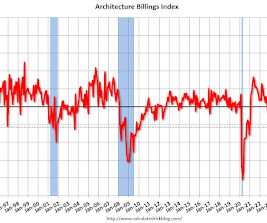

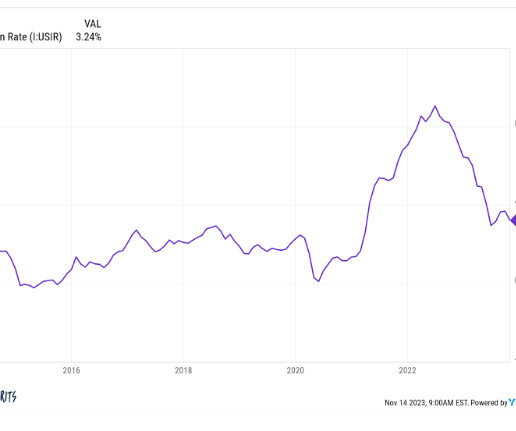

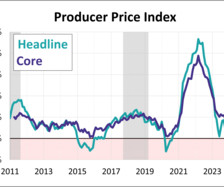

Markets screamed higher yesterday after a benign CPI report showed a 0.0% monthly price increase and inflation falling to 3.2% year over year. After a big gap opening, latecomers piled in; many had been sitting on the sidelines following a challenging 2022, while others got panicked out during the 10% October drawdown. It was a classic fear-driven error, a combination of bad market timing and poor impulse control.

Let's personalize your content