Tuesday links: looking average

Abnormal Returns

JANUARY 16, 2024

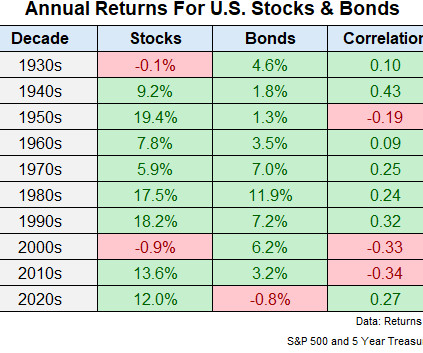

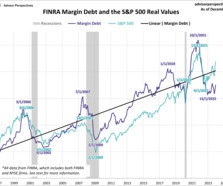

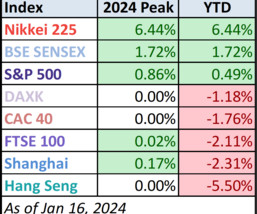

Markets Where are real interest rates going to settle? (mrzepczynski.blogspot.com) Domestic equities are expensive relative to international equities. (apolloacademy.com) Strategy Stocks usually beat bonds and cash, but not all the time. (awealthofcommonsense.com) How to identify an investor who has gotten too attached to a stock. (investmenttalk.co) Companies What went wrong at Boeing ($BA)?

Let's personalize your content