America’s Enormous Math Mistake’s Mistake

The Big Picture

JULY 21, 2023

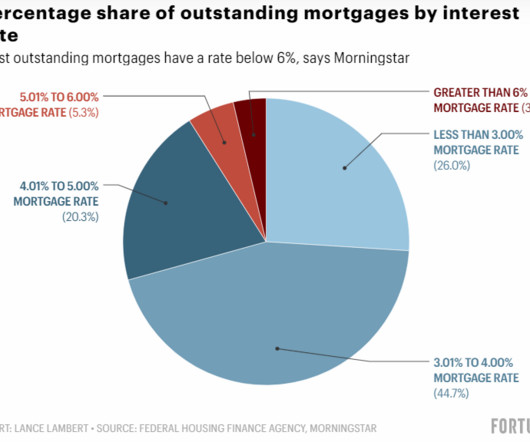

@TBPInvictus here; Let’s cut to the chase : A popular video on YouTube claims the poor are much less poor than the official statistics suggest because those statistics ignore government welfare programs like Food Stamps and Aid to Dependant Children and lots of other safety net programs. If this were true, it would mean we have been measuring income inequality incorrectly (perhaps wealth inequality as well).

Let's personalize your content