10 Friday AM Reads

The Big Picture

AUGUST 11, 2023

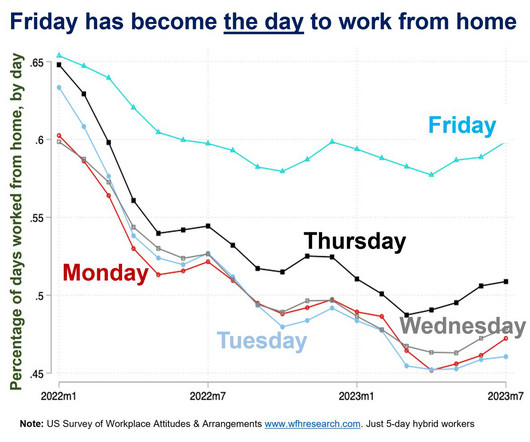

My end-of-week morning train WFH reads: • Seth Klarman on What Makes a Value Investor and Committing ‘Sacrilege’ in New Edition of ‘Security Analysis.’ Klarman edited the classic to remind investors of basic principles — but he questions “how much of this will be read by institutional investors who may think they know it all.” ( Institutional Investor ) • Flying Cars Are Nearly Here—and They’re Electric : Companies like Joby and Archer are about to begin production of electric vertical takeoff a

Let's personalize your content