Tuesday links: bailing at the wrong time

Abnormal Returns

JANUARY 9, 2024

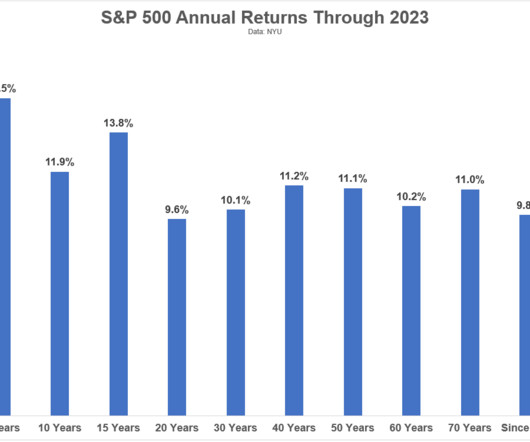

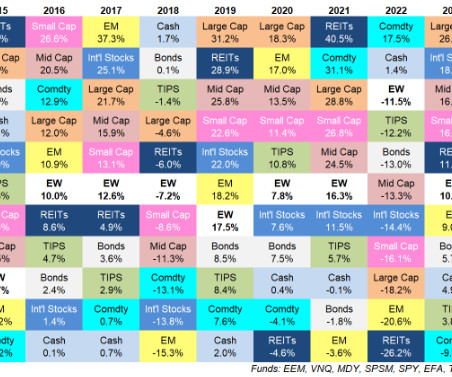

Markets The periodic table of commodity returns over the past decade. (visualcapitalist.com) Some more charts from 2023 including the drop in IPO activity. (entrylevel.topdowncharts.com) Alternatives Are private equity firms finally going to ramp up their exits via IPO? (ft.com) Venture capital volume is likely to stay muted in 2024. (institutionalinvestor.com) Carta is getting out of the secondary stock trading business.

Let's personalize your content