10 Monday AM Reads

The Big Picture

AUGUST 7, 2023

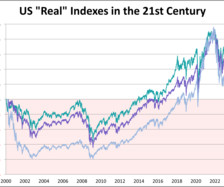

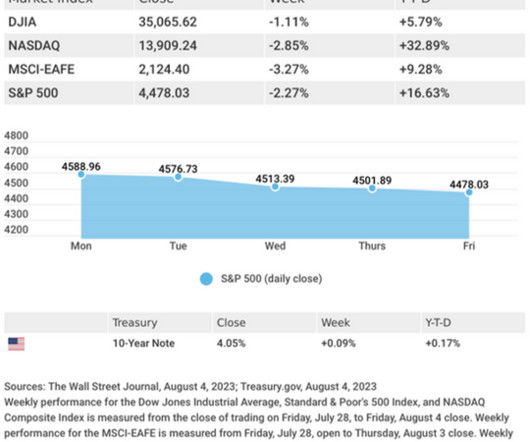

My back-to-work morning train WFH reads: • The Pandemic Small-Business Boom Is Fueling the US Economy : Startup registrations remain 42% ahead of 2019 levels, with growing numbers of companies founded by women and minorities. ( Businessweek ) • The Nifty Fifty => the Magnificent Seven : By May 1969, Buffett called it quits and wrote to advise his partners that he was closing the partnership: “I just don’t see anything available that gives any reasonable hope of delivering a good

Let's personalize your content