Retail Lobby: “We Lied About Organized Theft”

The Big Picture

DECEMBER 11, 2023

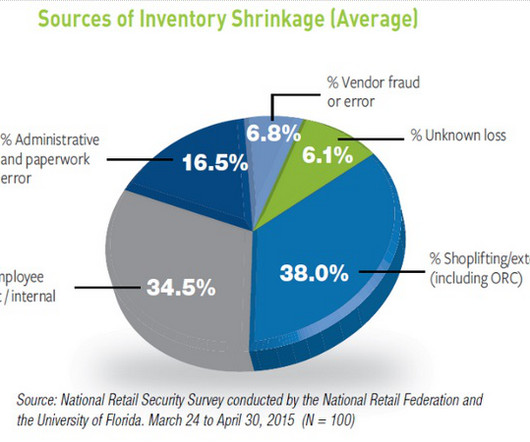

No, “ nearly half ” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.” That line is just another in a long series of falsehoods put forth by the professional b *s at the National Retail Federation. Here’s Reuters : “The main lobbying group for U.S. retailers retracted its claim that “organized retail crime” accounted for nearly half of all inventory losses in 2021 after finding that incorrect data was used for its analysis.

Let's personalize your content