Personal finance links: making big decisions

Abnormal Returns

AUGUST 16, 2023

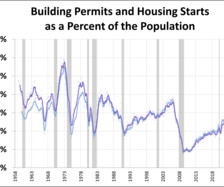

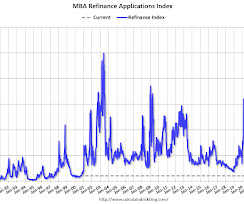

Podcasts Morgan Housel on how fragile the world can be. (open.spotify.com) Annie Duke talks decision making with Steven Pinker. (alliancefordecisioneducation.org) Joe Wiggins and Paul Richards talk about how regret affects our decision making. (podcasts.apple.com) Housing How to save for the biggest purchase in your life: a house. (ofdollarsanddata.com) Don't underestimate the upfront costs of buying a house.

Let's personalize your content