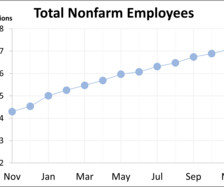

Monthly NFPs Are Rounding Errors

The Big Picture

DECEMBER 8, 2023

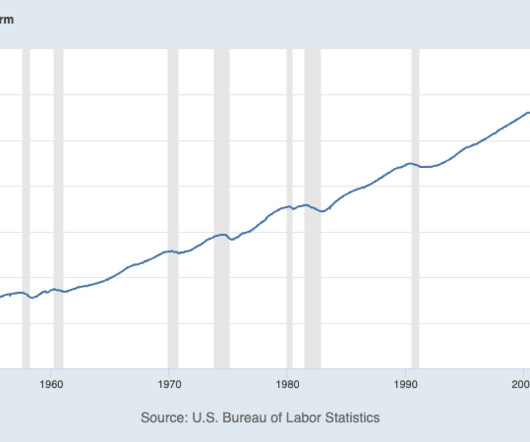

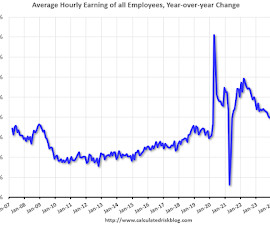

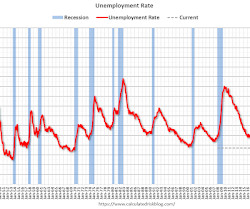

You may have missed the most important data point in today’s Employment report. It wasn’t that Nonfarm payrolls increased by 199,000 in November, somewhat higher than expected; nor was it the unemployment rate, which fell to 3.7% in November, from 3.9% in October; nor was it that Wages continued to rise at a modest pace, with average hourly earnings up 0.6%.

Let's personalize your content