10 Tuesday AM Reads

The Big Picture

JULY 18, 2023

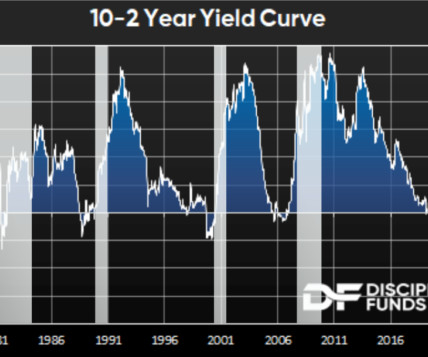

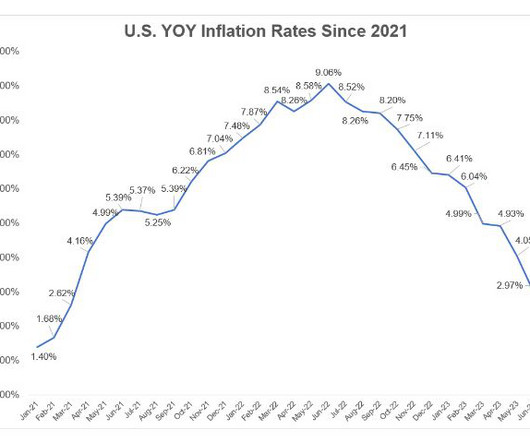

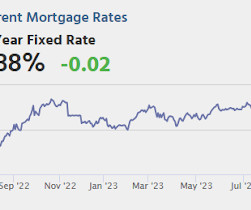

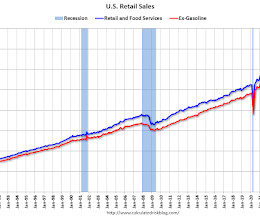

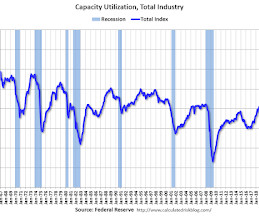

My Two-for-Tuesday train WFH reads: • Good News-Bad News About the Economy : The hard part about markets and the economy is that there are often conflicting signals about what’s going on. Even when things are good there are ominous signs about impending doom. And even when things are bad there are promising signs of impending improvement. I would describe the current situation as much better than expected considering the circumstances but there are still plenty of risks on the horizon. ( A Wealt

Let's personalize your content