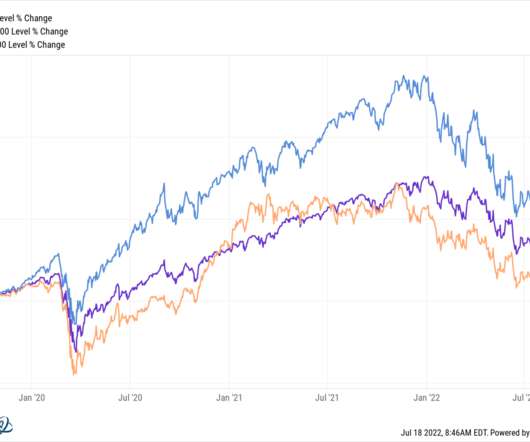

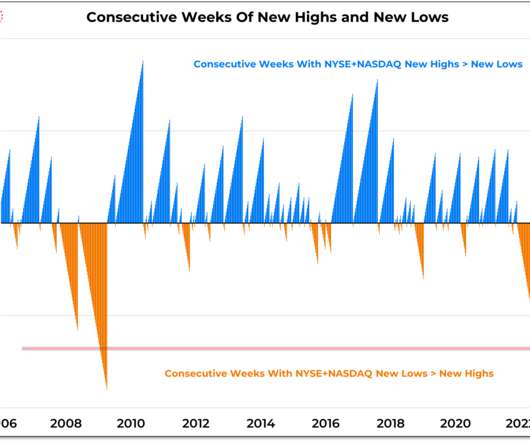

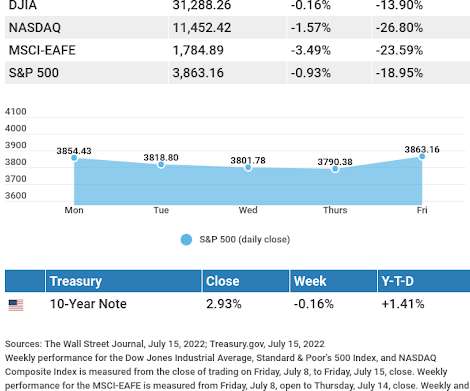

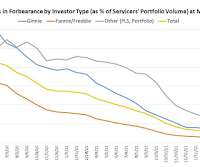

Rally??, Multiple Compression??, Earnings¯_(?)_/¯ Recession??, Double Bottom??

The Big Picture

JULY 18, 2022

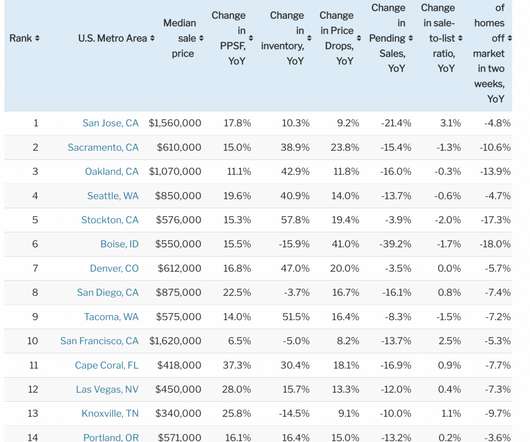

Ignore the emojis in the headline long enough to ask yourself this question: What might the rest of 2022 look like ? I did that exercise last week in response to a client inquiry about the second half of the year. The context was excess cash looking for a good long-term home (not a trade). The question was not so much where to put the capital, but rather when to deploy it.

Let's personalize your content