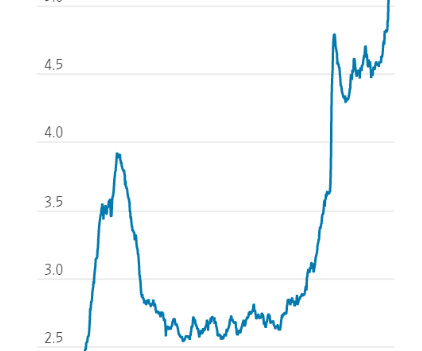

The Greatest Wealth Transfer in History Is Here

The Reformed Broker

MAY 16, 2023

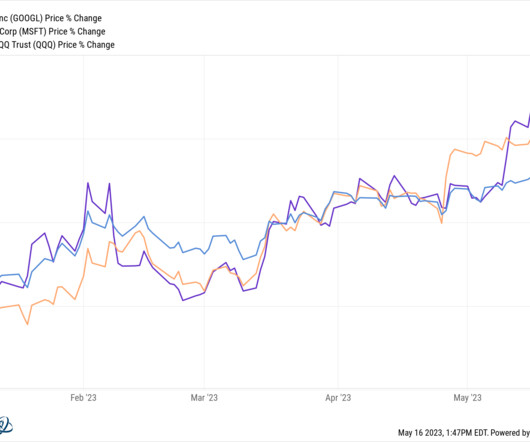

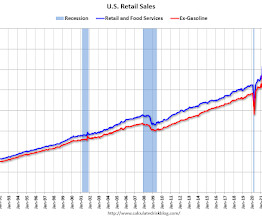

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Einhorn, Burry, Buffett – David Einhorn and Michael Burry were buying regional banks in Q1. ►Positive Surprises – “This will upset a lot of gloom and doomers, but oh well” ►Wealth Transfer .

Let's personalize your content