10 Bad Takes On This Market

The Big Picture

MAY 19, 2023

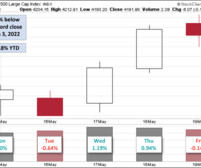

Let’s see if I can find something to counter and/or undercut each of these 10 items listed in this morning’s tweet above: 1. Only 5 stocks driving markets?! Then why are Equal-weighted indices doing so well? Equal-weighted Nasdaq100 up 17% since the June lows for the market because “it’s only 5 stocks”? How bad at math do you need to be to think that it’s only 5 stocks driving this market?

Let's personalize your content