Podcast links: fake podcast invites

Abnormal Returns

APRIL 26, 2024

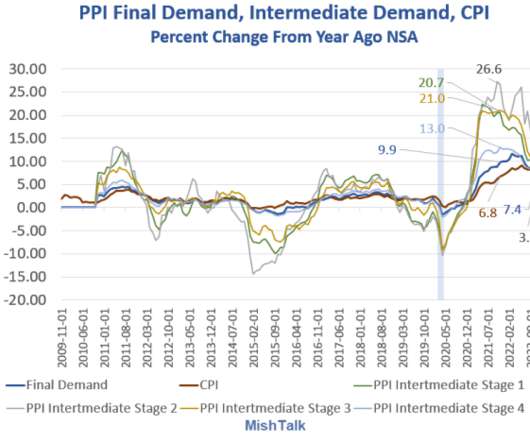

spyglass.org) Economy Barry Ritholtz talks with Bill McBride about which economic data really matters. ritholtz.com) James Pethokoukis talks economic optimism with Ed Yardeni. (bigtechnology.com) The Apple ($AAPL)-Spotify ($SPOT) battle is just exhausting.

Let's personalize your content