Wednesday links: an awesome product

Abnormal Returns

MARCH 20, 2024

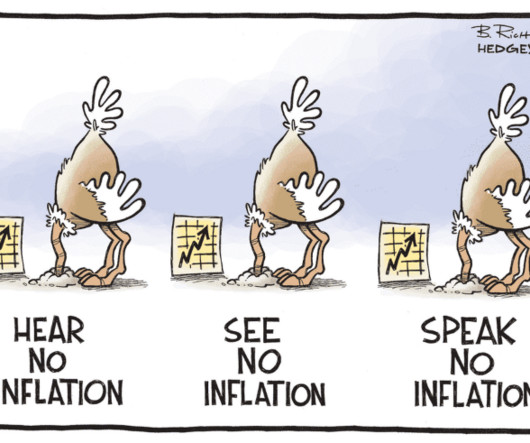

Strategy Ten things to know about building a diversified portfolio. morningstar.com) Real assets can be a portfolio drag during periods of quiescent inflation. marginalrevolution.com) Finance Private equity is stuck between elevated valuations high interest rates and a moribund IPO market.

Let's personalize your content