Financial Market Round-Up – Apr’24

Truemind Capital

APRIL 19, 2024

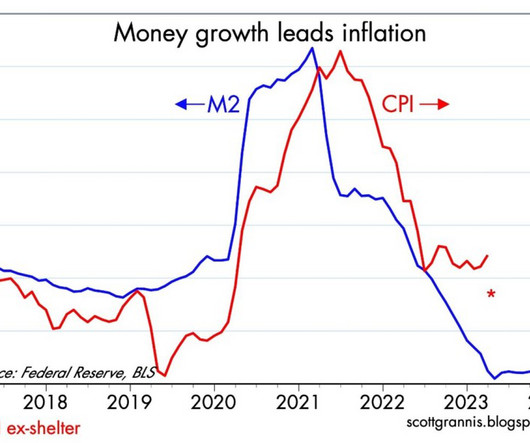

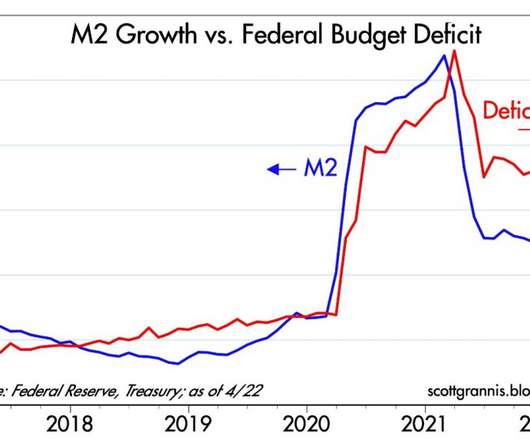

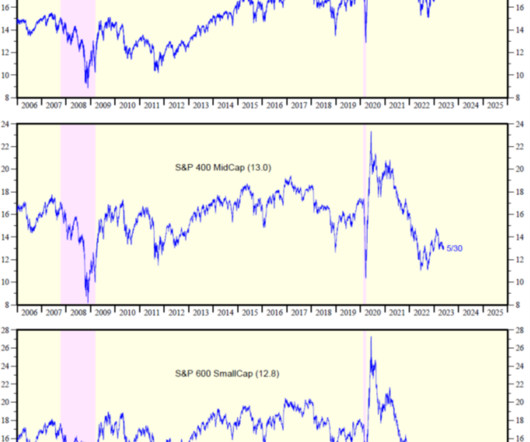

Here are some of the popular themes and the risks associated with them: Falling Interest Rates : There has been earnest demand by market participants to cut interest rates in the US and other developed economies on the back of falling inflation rates. Falling interest rates make money cheaper and thus fuel equity market returns.

Let's personalize your content