Sunday links: a nation of bad drivers

Abnormal Returns

APRIL 21, 2024

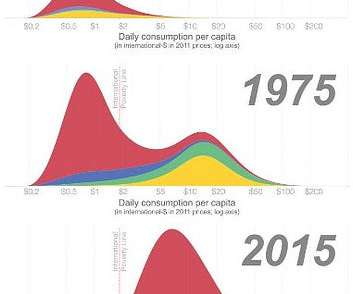

humbledollar.com) Companies Why Boeing ($BA) took its eye off manufacturing quality. npr.org) Economy Why wealth inequality is growing. disciplinefunds.com) The Fed's communication regime is a mess. papers.ssrn.com) The economic schedule for the coming week. (microcapclub.com) No portfolio strategy is perfect.

Let's personalize your content