Capital Small Finance Bank IPO Review

Trade Brains

FEBRUARY 5, 2024

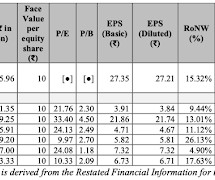

The bank has a diversified portfolio of 99.85% of secured loans, with an average gross NPA of 2.52% and Net NPA of 1.3% Many microfinance institutions received licenses due to their experience serving low-income groups. Players like AU SFB and Capital SFB are the only two that are not NBFC-MFIs to receive an SFB license.

Let's personalize your content