Monday links: following a recipe

Abnormal Returns

AUGUST 21, 2023

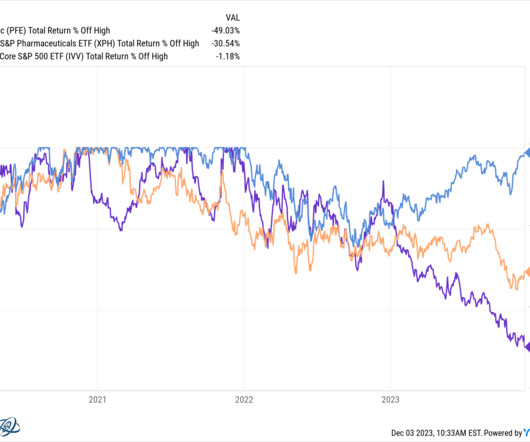

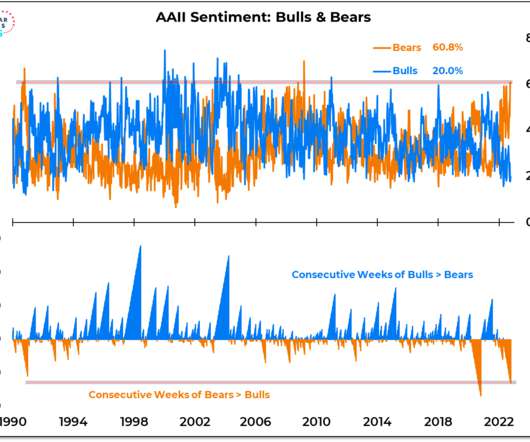

Asset allocation Asset allocation is not a science. insights.finominal.com) Economy Aging isn't great for economic growth. obliviousinvestor.com) Diversification reduces the risk of adverse outcomes. barrons.com) Strategy Everyone and everything ends up underperforming at some point.

Let's personalize your content