Financial Market Round-Up – Jul’23

Truemind Capital

AUGUST 12, 2023

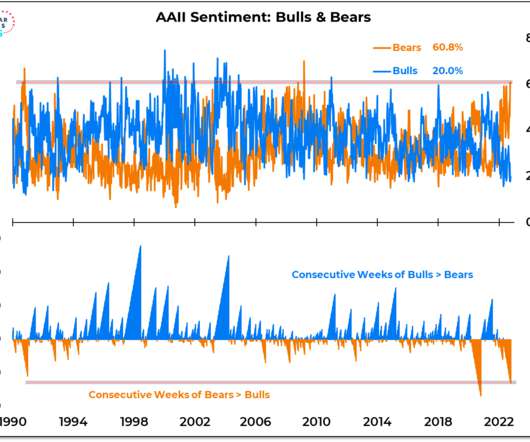

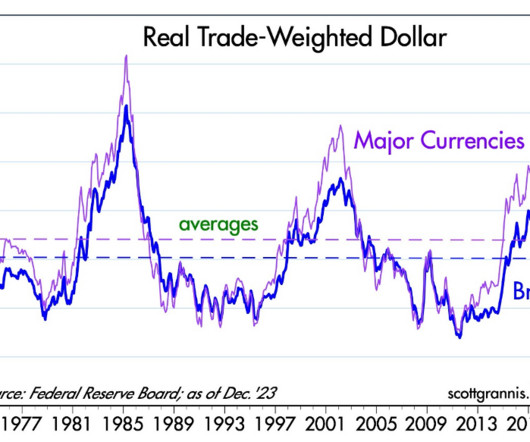

Equity Market Insights : Where is the recession? Despite being widely expected for many months, the recession has yet to materialize in the US and other developed economies. The recent rally in the market has made the valuations more expensive compared to historical standards.

Let's personalize your content